This post may contain affiliate links(s). An affiliate link means I may earn advertising/referral fees if you make a purchase through my link,

without any additional cost to you. It helps to keep this site afloat. Thank you in advance for your support. If you like what we do here, maybe buy me a

coffee.

Canon Strategy Conference 2024

Canon released its annual shareholders' report, which is a more in-depth look into Canon's financials. Canon's year-end financials were out on January 30th of this year, and the outlook was exceptionally positive. Another site looked at a report that was over a month old, and I have to admit, I skipped the strategy conference this year, so let's go back to March while we wait for Canon to release their first quarter results in a few days' time.

I should look at more than just imaging, because Canon has a lot of exciting things happening, especially with its lithography systems. I covered this topic more while I was writing for another website, and I will catch up on this on CanonNews and give more of my thoughts on all this, as Canon's lithography equipment is going through some incredible evolution right now.

Canon's imaging department had the following goals leading up to the current year as;

- Achieve an overwhelming No.1 share in mirrorless camera market by continuously introducing attractive products that can be realized only by the EOS R system

- Expand lineup of hybrid cameras and lenses to meet the needs of both still photography and video shooting

- Provide young people with a different value experience from smartphones

- Improve functions and performance of cameras and lenses using technologies including AI

- Provide top quality service and support with the aim of zero downtime, ensuring professionals work without any stoppages

While I am impressed by their goals, I'm curious to see how the EOS RF system will expand to have things that only Canon EOS R systems can do. But this is the Canon I know and love. This is also what drives them to ensure they are #1 in all markets. The second point we are seeing, especially late last year with the addition of VCM lenses, and this year, with the EOS "V" series of cameras. The value proposition from smartphones is coming, but slowly. The entire software aspect of the phone vs camera, Canon and the other Japanese camera manufacturers have this huge blindspot, which remains one of the largest hurdles, and the portability issues that come with larger cameras and lenses.

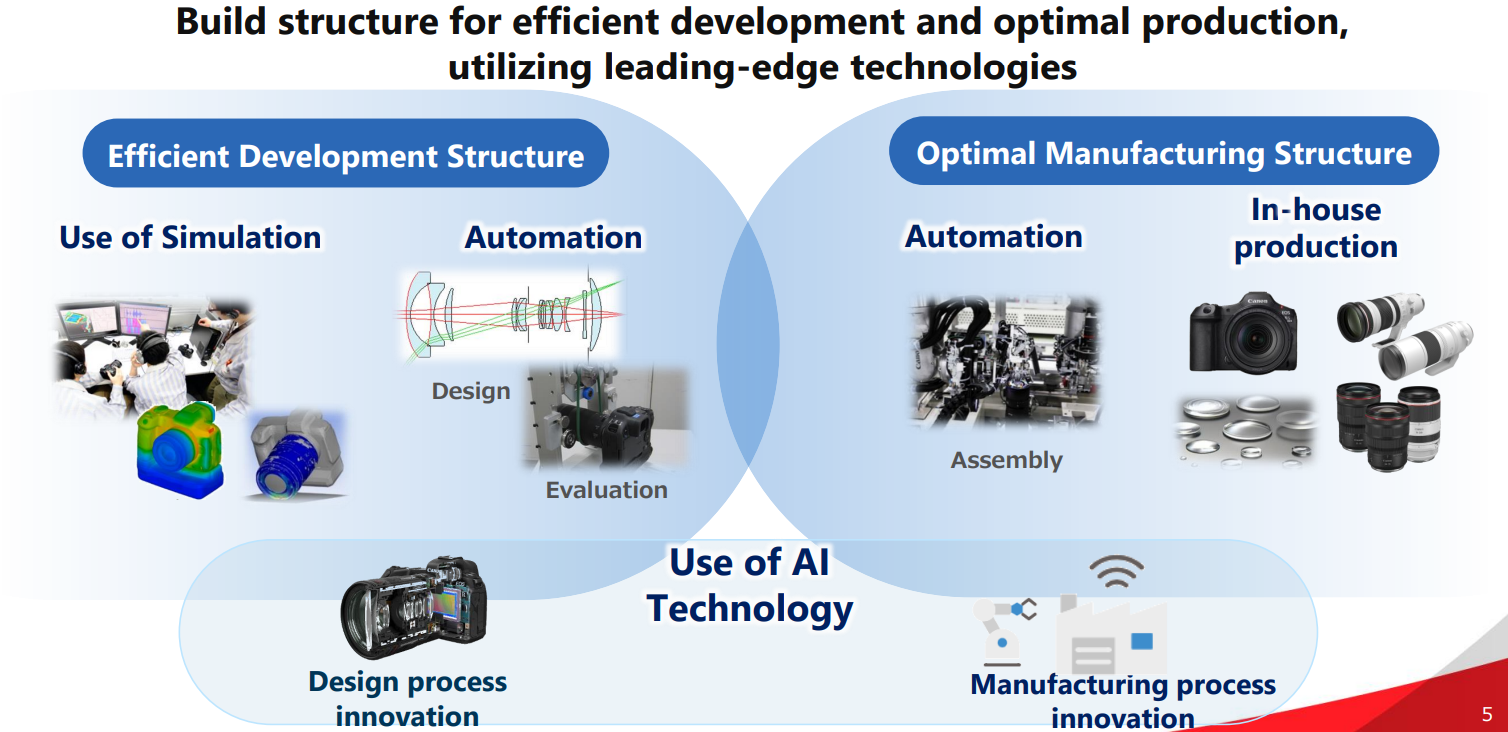

Canon also mentions that they have been improving productivity by furthering the use of automation in their factories. Canon has always been a leader in automation in its factories, and you can go back to the 2010s to find information on this.

For instance, during a dpreview walkthrough of the Utsunomiya plant, these machines were creating the optical elements for the Canon EF 16-35mm F2.8L III IS USM in a matter of minutes, versus weeks.

At the time, even the Canon EF 16-35mm F2.8L IS USM III was 50% automated, and Canon had the goal of 80% automation by the end of that year (2017). Canon showed off the image below in its literature, and it's a good look at Canon's ongoing efforts in the early part of the 2000s.

Back in 2017, as well, Canon started the planning of a new camera plant in the Miyazaki Prefecture and expected to have it running by 2019, focusing on the automated manufacturing of cameras. This camera plant was supposed to deliver, at the time, semi-automated production of cameras. This was during the trend in the late 2010's to move production back to Japan.

So what is new isn't the automation, but the use of AI technology to improve the elements that were preexisting in Canon's development lifecycle. Hopefully, Canon can use this AI to more easily predict selling patterns so they don't have to write apology letters because they didn't anticipate pre-orders, and they ran out of inventory ;) Though I'm not sure how much is just buzzwords, because everything now has to include AI somewhere.

Canon mentioned network cameras quite a bit in the imaging department, and I wouldn't be surprised if this is Canon's true focus in the imaging space as time goes on. When I read the patents (you know, the ones the other sites do not), I would say it's close to 2:1 between network cameras and consumer cameras in terms of patent applications. Automotive, which I was very surprised was omitted from their strategy documents, is easily 3 to 4:1 in terms of patent applications. In other words, any time I now read a sensor patent, odds are it's for something other than consumer or professional cameras. Canon does mention their component business, but considering how much work in research happens in the automotive space, I am surprised we have not heard more about their SPAD and other sensors used in autonomous vehicle designs, etc.

What does this mean for us? Honestly - more of the same.

People weren't purchasing old PowerShots for hybrid video, they were purchasing them for both the retro look and also the step up in imaging quality. I find the V1 focuses a little too much on the video, and Canon also needs to consider that some people just want a small 1", m43's or APS-C grab and go compact form factor camera. Ricoh and Fuji have sold well in Asia; Canon should take note of this.

The market drove the focus on compact cameras and smaller cameras. If anything, Canon and the rest of the industry weren't nimble enough to see this happening over a year ago. So they are catching up with the market, which has been happening for a while. The PowerShot V1 was a good start, but there needs to be far more done to the PowerShot ecosystem.

Canon and the other manufacturers should also sit up and take notice of what Oppo and Xiaomi were showing off this year, as it's a dramatic threat to their camera systems by mobile/technology companies with enough R&D money to take on the Japanese camera manufacturers.

Xiaomi's system solves most of the problems with adding a larger lens to a phone camera, while still having the optimized image processing and pipeline of a smartphone. So it's not just the Japanese camera companies that have watched the trends; the smartphone companies have taken notice as well, and unlike decades in the past, the smartphone manufacturers have better tools in place and more compelling options for their consumers.

Canon sums up the imaging department's goals nicely with this quotation.

Accelerating growth by creating attractive products and responding to increasingly diverse needs As for digital cameras, it is important for us, as a leading company of cameras, to continue to provide attractive products to users, including younger generations, and to stimulate the market going forward. Canon will offer a lineup that satisfies both demand for still image photography from professional photographers and camera enthusiasts, and for diverse video recording from social media users.

Demand for network cameras for surveillance applications continues to increase to ensure safety and security against disasters and crimes.

At the same time, the need for in-store marketing and for production control at manufacturing sites are growing. Canon will accelerate its growth by responding to diversifying demand.

I look forward to seeing how Canon looks to accomplish these goals, they will certainly have to be more responsive than they have in the past.