CIPA June: The Rise of Europe

CIPA released the June results for the tracked shipments of Japanese camera manufacturers today, and there’s some interesting results.

First the overall results for the month show a continuation of matching last year’s shipments, almost to the unit. This trend has now basically occurred since the earthquake effect finally leveled off after the first couple of months of the year.

If you missed that from our earlier reports, last year, in the first few months of the year, manufacturers were still playing catch up with delayed new releases from the prior year, creating an overly large first couple of the months of shipment, which is why this year’s first couple of months didn’t match the shipment totals.

Since then, we have seen the shipments be rather predictable, matching month for month the shipments between 2018 and 2017. CIPA is showing that compacts continue to bleed, where they are continuing to lower the amounts shipped on a year by year basis. The loss to smartphones is continuing for compact cameras.

We expect this to continue for the rest of the year, which ultimately will have the ILC shipment totals at slightly lower than last year but signaling that the bottom has been reached for the market.

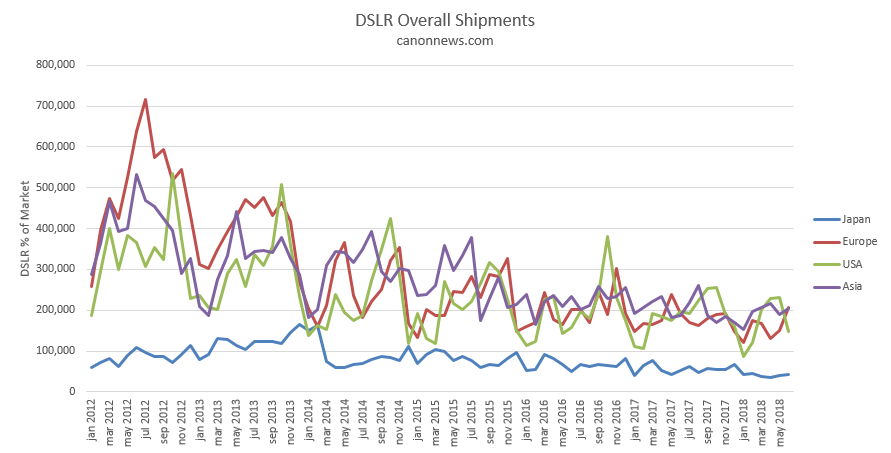

The second thing we noticed was the rise of Europe for shipments in June. Europe narrowly missed out as being the largest single market for mirrorless. Europe has always seemed to have more adaptation of mirrorless, especially when compared to the Americas, but has never had the global marketshare % of mirrorless to support it. Also, with Europe this last month, DSLR shipments were the highest of any region, making Europe for some reason this month a hot market for both DSLR and mirrorless. Whether this rise was due to a one-time shipment, or a continued trend is something that will be interesting to watch over the next couple of months.

As a result, the Asia (including Japan) marketshare fell to under 50% for its global share, which is one of the few months that this has happened since mirrorless has been tracked independently.

Unit vales for DLR’s remained steady over all regions, which would tend to indicate that the product mixes that are currently shipping have been shipping for a few months now. Does this spell the end of D850 shipments? Perhaps. Stock levels are starting to increase around the world on the D850.

With mirrorless, Americas still rules the unit value race, however the large spike in unit value caused most likely by the mass shipment of A7III’s has dissipated. Even with that, the unit values show a slight rebound from May, signaling, as we are seeing that A7III’s are possibly still being shipped making up for stock shortage. The product mix is still changing for the regions, with the Americas getting closer to the same product mix as the other regions, but still carrying a higher per unit value, or a mix containing an increased amount of higher end units than other regions.

We are predicting that we will continue to see 2018 match 2017 values, and post a slightly lower overall year to 2017, with mirrorless continuing to make up more of a share over DSLR's. As we see from Canon's financials, the mirrorless mix for Canon is changing, which will cause a change in the overall market mix between mirrorless and DSLR's. Also adding to that the new shipping Nikon full frame mirrorless and possible a new Canon full frame mirrorless camera, and the increased presence of both Fuji and Sony as well, and mirrorless cameras will continue to rise as a share of the market.

We are predicting that we will continue to see 2018 match 2017 values, and post a slightly lower overall year to 2017, with mirrorless continuing to make up more of a share over DSLR's. As we see from Canon's financials, the mirrorless mix for Canon is changing, which will cause a change in the overall market mix between mirrorless and DSLR's. Also adding to that the new shipping Nikon full frame mirrorless and possible a new Canon full frame mirrorless camera, and the increased presence of both Fuji and Sony as well, and mirrorless cameras will continue to rise as a share of the market.

3752